Explore web search results related to this domain and discover relevant information.

PBOC CNY reference rate setting for the trading session ahead.

Trump to Jerome "Too Late" Powell...You should be ashamed. Rates should be paying 1% ... Later this year, ForexLive.com is evolving into investingLive.com, a new destination for intelligent market updates and smarter decision-making for investors and traders alike.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain range, called a "band," around a central reference rate, or "midpoint." It's currently at +/- 2%.People's Bank of China USD/CNY reference rate is due around 0115 GMT.

Rates Trading Desk: What is Rates Trading, Differences vs. Credit Trading, How to Network and Interview for Jobs, A Day in the Life, and Exit Opportunities.

Q: Before we get started, can you explain what the “rates trading desk” does and how it’s different from other areas in FICC Trading, such as credit trading? A: Most assets that a bank trades are split into cash vs. derivatives vs.Other derivatives include caps and floors, STIRT futures, Eurostrips, swaptions, and interest rate call options. “Making a market” means providing liquidity to clients who want to buy and sell. We commit to buy and sell anything from clients, even if we don’t want the position, and then we address the risk and try to turn it into a profitable trade.You need senior traders across the desks to like you, so say that you’re open to anything, even if you do have a preference for one product. You can always say that you’re very interested in what the person does and that you would like to know more, as markets people love to talk about their own roles. Q: Thanks for that summary. Can you walk us through an average day on the rates trading desk?However, they’re also far less likely to earn “star trader” bonus packages as managers, and their total compensation may fall. Q: On that note, how long do most rates traders stick around?

The main stock market index of United States, the US500, rose to 6531 points on September 10, 2025, gaining 0.28% from the previous session. Over the past month, the index has climbed 2.47% and is up 17.59% compared to the same time last year, according to trading on a contract for difference ...

The main stock market index of United States, the US500, rose to 6531 points on September 10, 2025, gaining 0.28% from the previous session. Over the past month, the index has climbed 2.47% and is up 17.59% compared to the same time last year, according to trading on a contract for difference (CFD) that tracks this benchmark index from United States.

Use our free currency converter. Get accurate and reliable foreign exchange rates, based on OANDA Rates™.

To use OANDA’s free currency converter, type into the relevant field currency names, 3-letter ISO currency symbols, or country names to select your currency. You can convert world currencies, precious metals, or obsolete currencies. You can also access currency exchange rates dating back to January 1990.Also known as the mid-market rate, the spot rate or the real exchange rate, the interbank rate is the exchange rate used by banks and large institutions when trading large volumes of foreign currency with one another.Currency conversion rates differ between companies as each company manipulates the interbank rate to make a profit. This is usually done on volume; the higher the volume, the closer you get to the interbank rate.We come across a lot of competitors that post interbank rates online as a bait to hook new customers, but, once customers are onboard, they change the rate drastically, not usually in the customers’ favour.

With our complete list of foreign exchange (Forex) up-to-the-minute pricing, changes, ranges, day charts and news, Yahoo Finance helps you make informed decisions with your money.

Trader Talk · Financial Freestyle · ETF Report · FA Corner · Options Playbook · Watch Now · … · Upgrade to Premium · U.S. markets closed · US Europe Asia Cryptocurrencies Rates Commodities Currencies · S&P Futures · 6,535.50 · +13.75 · (+0.21%) Dow Futures ·

Follow along for a typical day of a first year Rates Trading Analyst on the Interest Rate Swaps Desk in New York. Enroll in an S&T Boot Camp here!

Follow along for a typical day of a first year Rates Trading Analyst on the Interest Rate Swaps Desk in New York. Rates Trading sits within Fixed Income and would include products such as treasuries, agencies, interest rate swaps, interest rate options and repo/financing. Let me take a step back and tell you about what I trade.The market has grown from just a risk management tool to an asset class and where investors use Interest Rate Swaps to express a view on rates (rates going up or down). What surprised me when I joined was how huge the swap market is. The USD Swap Market has over 100 trillion in notional outstanding, compared to 41 trillion in notional for all Fixed Income Securities (bonds). There are 2.5 times the number of swaps than bonds to hedge. As a result in my job there are two sides to the trade: Me ( The Trading Desk ) and the Client.The client on the other side who pays the floating rate thinks rates are going down. Receive Fixed: Trader receives the fixed rate and pays the floating rate.Size: What notional are we going to exchange rates for? If the Fixed Rate is 1.85%, it’s 1.85% times what notional. My job as a trader is to quote fixed rates that we would pay fixed and receive LIBOR, or vice versa, rates where we would receive a fixed rate and pay LIBOR.

Calculate live currency and foreign exchange rates with the free Xe Currency Converter. Convert between all major global currencies, precious metals, and crypto with this currency calculator and view the live mid-market rates.

We use the mid-market rate for our Converter. This is for informational purposes only. You won’t receive this rate when sending money.Set free rate alerts for any currency pair.Analyze rate trends for any currency over a few days, weeks, months, or years.Our exchange rate API offers real-time, accurate, and reliable data for hundreds of currencies.

This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for - Currency Exchange Rates. Foreign exchange is the largest financial market in the world as volume averages $5 trillion per day, according to the Bank for International Settlements.

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates.

Set free rate alerts for any currency pair.Analyze rate trends for any currency over a few days, weeks, months, or years.Our exchange rate API offers real-time, accurate, and reliable data for hundreds of currencies.✨ Get a better rate on your first 3 transfers. Register by October 1.

This paper provides econometric evidence on how exchange rates respond to tariffs. We construct a new tariff-shock database, which captures tariff-related announcements, threats and implementations by the US, China, the euro area and Canada between 2018 and 2020, and in 2025.

Staff working papers set out research in progress by our staff, with the aim of encouraging comments and debate.We show that exchange rates react to US tariff shocks in systematically different ways depending on retaliation: the US dollar (USD) appreciates if the tariff is imposed unilaterally, but depreciates if other countries retaliate. This empirical pattern resonates with the predictions of recent open-macro models with dominant currency pricing.Our shock measure accounts for both the size of tariff rates and their economic relevance.Trading blows: The exchange-rate response to tariffs and retaliations

US Europe Asia Cryptocurrencies Rates Commodities Currencies ... TVTX Travere Therapeutics, Inc. ... SOC Sable Offshore Corp. ... CRWV CoreWeave, Inc. ... SNPS Synopsys, Inc. ... RBRK Rubrik, Inc. ... CHWY Chewy, Inc. ... OPEN Opendoor Technologies Inc. ... NIO NIO Inc. ... AAL American Airlines Group Inc. ... SNPS Synopsys, Inc. ... TTD The Trade ...

US Europe Asia Cryptocurrencies Rates Commodities Currencies ... TVTX Travere Therapeutics, Inc. ... SOC Sable Offshore Corp. ... CRWV CoreWeave, Inc. ... SNPS Synopsys, Inc. ... RBRK Rubrik, Inc. ... CHWY Chewy, Inc. ... OPEN Opendoor Technologies Inc. ... NIO NIO Inc. ... AAL American Airlines Group Inc. ... SNPS Synopsys, Inc. ... TTD The Trade Desk, Inc.At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.Oracle exploded higher after its earnings report. Meanwhile, new data pointed to moderating inflation, cementing rate-cut bets.

Get started trading interest rates with our introductory guide. Learn how treasury yields operate and how to trade them with futures products.

Higher interest rates often suggest less economic growth or a contractionary period, whereas lower interest rates can spur economic growth or an expansionary period. However, there’s greater nuance to interest rates which can provide an opportunity for traders to speculate on the future path of rates or manage risk in investments and everyday life.US Treasury interest rates are some of the most oft-quoted benchmarks in the entire asset class, and they are commonly referred to as the risk-free rate of return in investment modeling. Treasury rates (or yields) are referenced in daily news items concerning markets as well as loan agreements affecting both everyday people and large public companies. They are the underlying market for many popularly traded interest rate products.Given its central position in the US Yield Curve between short-term rates (2 Year) and long-term rates (30 Year), the 10 Year US Treasury can garner some of the greatest trading volumes. It can be thought of as the S&P 500 of interest rates as it is the quoted benchmark in many news items pertaining to this asset class. You can trade this market with Small 10 Year US Treasury Yield futures.The 30 Year US Treasury Yield measures the interest rate on 30 Year US Treasury Bonds. Given its greater duration than the 2 Year and 10 Year, the 30 Year US Treasury can be viewed as a longer-term benchmark that moves with greater volatility than other parts of the US Yield Curve. You can trade this market with Small 30 Year US Treasury Yield futures.

The November 5 US presidential elections, Federal Reserve interest rate decision, trading activity of foreign investors, and the upcoming quarterly earnings from domestic firms are the major triggers that would influence sentiments in the equity market this week, analysts said.

"The outlook for the market will be guided by the US presidential election and major macroeconomic data such as HSBC India manufacturing PMI, services PMI, US Fed interest rate decision, US S&P global composite PMI, US S&P global services PMI and BoE (Bank of England) interest rate decision," Palka Arora Chopra, Director, Master Capital Services Ltd, said."Global markets will respond to the US presidential elections for a few days, after which fundamentals like US GDP growth, inflation and rate cut by the Fed will influence market moves," said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

Current exchange rates of major world currencies. Find updated foreign currency values, a currency converter and info for foreign currency trading.

Currency rates are representative of the Bloomberg Generic Composite rate (BGN), a representation based on indicative rates only contributed by market participants. The data is NOT based on any actual market trades. Currency data is 25 minutes delayed, provided for information purposes only and not intended for trading; Bloomberg does not guarantee the accuracy of the data.This website is for information purposes only. Please see the Bloomberg Fixings and Reference Rates page for Key Facts, Documentation and Latest News on the Bloomberg FX Fixings (BFIX).

A nation's currency exchange rate is one of the most important determinants of its economic health. Along with interest rates and inflation rates, exchange rates play a vital role in a nation's level of trade, which is critical to nearly every free market economy in the world.

The opposite relationship exists for decreasing interest rates. That is, lower interest rates tend to decrease exchange rates. The current account is the balance of trade between a country and its trading partners, reflecting all payments between countries for goods, services, interest, and dividends.A deficit in the current account shows the country is spending more on foreign trade than it is earning, and that it is borrowing capital from foreign sources to make up the deficit. In other words, the country requires more foreign currency than it receives through sales of exports, and it supplies more of its own currency than foreigners demand for its products. The excess demand for foreign currency lowers the country's exchange rate until domestic goods and services are cheap enough for foreigners, and foreign assets are too expensive to generate sales for domestic interests.For this reason, the country's debt rating (as determined by Moody's or Standard & Poor's, for example) is a crucial determinant of its exchange rate. A ratio comparing export prices to import prices, the terms of trade is related to current accounts and the balance of payments.Inflation, interest rates, account deficits, trade balances, and public debt all affect currency exchange rates.

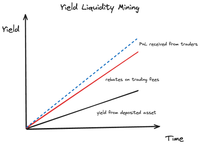

In simple terms, traders can profit by predicting the average yield of an asset over a future period or by locking in the future returns of a yield-bearing asset. Essentially, yield trading is a derivative product based on yield. In traditional financial markets, interest rate derivatives are ...

In simple terms, traders can profit by predicting the average yield of an asset over a future period or by locking in the future returns of a yield-bearing asset. Essentially, yield trading is a derivative product based on yield. In traditional financial markets, interest rate derivatives are the most traded products globally, with an annual trading volume of $5 trillion.In DeFi, we have created a token called Yield Token (YT) to enable yield trading in a tokenized form.RateX’s trading system allows traders to profit by buying and selling YT tokens.You can simply think of ST as interest-bearing money. Users can use ST to long or short YT, and RateX allows users to trade YT with up to 10x leverage.2. The system also generates some YTs for the LP, representing potential future yield (RateX gives LPs a credit to issue YT based on the ST they hold and its future earnings. The maximum amount of YT they can issue is decided by a parameter called the AR-Coefficient.). 3. Finally, the LP creates a trading pair with the generated YT and ST for other traders to exchange.

The bank believes USD/CAD will increasingly be driven by this narrowing rate spread, forecasting the pair to trade primarily between 1.34 and 1.36 — a zone of heavy price congestion during 2023 and 2024.

Rabobank sees limited BoC easing ahead, narrowing US-Canada rate gap to weigh on USD/CADRabobank expects the Bank of Canada (BoC) to deliver one final 25 basis point rate cut, likely at the October meeting. However, Rabo sees the risk tilted toward no further easing.Looking further ahead, Rabobank anticipates the US-Canada interest rate differential — currently at 175 basis points — will narrow to around 75 basis points by the end of 2026, as the Federal Reserve accelerates its own rate-cutting cycle.The Bank of Canada held its policy rate at 2.75% in July.The BoC is expected to have already reached its terminal rate of 2.50% by that stage.

Get real time currency exchange rates for dozens of major foreign currency pairs as well live currency charts, historical data, news & more.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.Access live currency rates on all major currency crosses in an easy-to-read format. Assess the bid, ask, open, high, low and currency rate changes.

CME Group reported a rise in third-quarter profit on Wednesday, as uncertainty around U.S. monetary policy and geopolitical events sent investors into the derivatives markets to manage risks, bolstering trading volumes for the exchange.

The ADV of interest rate products, used to hedge against volatility stemming from changes in benchmark interest rates, jumped 36% to a quarterly record of 14.9 million contracts.Duffy said opposing views on Fed policy should provide further tailwinds for interest-rate trading, while continued uncertainty around the U.S.election and geopolitics will drive liquidity and risk management needs across rates and other asset classes.

Hedging and speculation play a crucial role in managing market risk.

Interest rate traders can now execute Pack and Bundle orders for CME Group SOFR futures contracts.Investors balance their portfolios between equities and fixed income based on factors like risk tolerance, liquidity needs, and economic conditions, with the 60/40 rule serving as a flexible guideline. Hedging and speculation play a crucial role in managing market risk, with equities typically hedged using options, while fixed-income investors utilize futures contracts to navigate interest rate movements.Learn More About IBKR 1. IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs.For those wanting to trade markets using computer-power by coders and developers.